Multi-level Accounts

Create and manage an account structure that is flexible and aligned to your financial requirements with our accounts management software. Get support for multi-level accounts, cost centres, and departments, to organize efficiently and track more accurately. Ensure streamlined reporting across business units and operations for greater clarity.

General Ledger (GL)

Efficient management of general ledger that enables automation from all other departments or posting of manual journal entries. Achieve accuracy, adhere to compliance, and gain visibility into your financial transactions with features like inbuilt approval workflows, detailed audit trails, and support for recurring and reversing journals.

Recurring Vouchers

Easy configuration of recurring entries like rent, utility bills, insurance premiums, salaries, and subscriptions can be posted automatically on pre-defined schedules. Save time and effort, enhance accuracy, and ensure consistency for routine transactions across outlets and business units.

Accounts

Receivable (AR)

Stay on top of your accounts receivables by monitoring customer outstanding continuously with our inventory and invoice software. Ensure that you never miss a payment, by applying collections to invoices, efficiently managing credit notes, and tracking overdue payments through ageing reports. Follow up with customers promptly and boost invoice payment conversions.

Accounts

Payable (AP)

Manage supplier invoices efficiently, track due dates consistently and schedule payments to avoid late payment penalties. Easily handle debit notes and have clarity and real-time visibility into outstanding payables, helping your firm to maintain robust relationships with vendors and exercise greater control over your cash flow.

Fixed Assets &

Depreciation

Maintain a comprehensive register of assets, automate maintenance and servicing, and depreciation schedules in line with accounting standards. Get the exact picture of the value of your assets at any given time. Manage intra company transfers diligently, gaining 360-degree visibility into your assets for easy location and retrieval.

Expense Allocation &

Admin Distributions

Allocate costs including overheads across departments, cost-centres, projects, or branches with precision. Streamline admin cost distribution and track expenses accurately, efficiently budgeting to ensure smooth cash flows. With rule-based cost allocation and profitability analysis, meticulously track every rupee, gaining sharp financial insights.

Bank Reconciliation

Smooth and easy bank reconciliation with system transactions help ensure precision in financial records, with manual overrides and auto-matching. Identify mismatches, point out discrepancies, and simplify adjustments to save time, eliminate errors, and gain clarity about your company’s cash position in real-time. Get audit-ready reports, and maintain compliance.

Financial Reports &

Statements

Generate financial statements like the Profit & Loss Statements, Balance Sheets, Trial Balance, Cash Flow Statements, and any other statements required for checking the financial health of your business and for audit purposes, swiftly, and precisely, with complete drill-down capability.

Multi-Currency

Support

Transactions across countries and business units are no longer problematic with multi-currency support provided by our finance management software. Get accurate, real-time exchange rate updates, track gains and losses in currency conversions. Ensure compliance with international regulations, smooth international transactions, and get a precise picture into overall cash and profitability situation.

Audit Trails & Approval

Workflows

Get in-depth audit trails that track every single financial transaction, maintaining a detailed log, and allowing role-based access controls. The inbuilt approval workflows allow better control and transparencies, ensuring swift and efficient approval mechanisms for critical transactions, maintaining a secure and traceable record.

Financial Analytics & Dashboards

Visually rich and detailed dashboards in our inventory and accounts software provide a bird’s eye view of overall financial position, revenues, expenses, and profitability. Make informed and smarter decisions, accurate predictions for the immediate future, identify wasteful expenditure, and take remedial measures to rectify them. And so it one of the best finance management software on the market.

Taxation

Ensure accurate calculation of tax liability, keep track of due dates, and remit taxes in time to avoid penalties. Maintain adherence to domestic and international regulations, facilitate business continuity, generate precise tax reports, minimize errors, and simplify audits, reducing manual effort.

Budgeting and

Controls

Our robust budgeting tools empower you to plan smarter. With our retail finance management solution, you can set financial limits, track actual against budgets, and avoid overspending. Configure the system to send you alerts in real-time, and gain valuable insights from analytics. Make informed decisions, maintain financial discipline, and drive sustainable growth across your company branches.

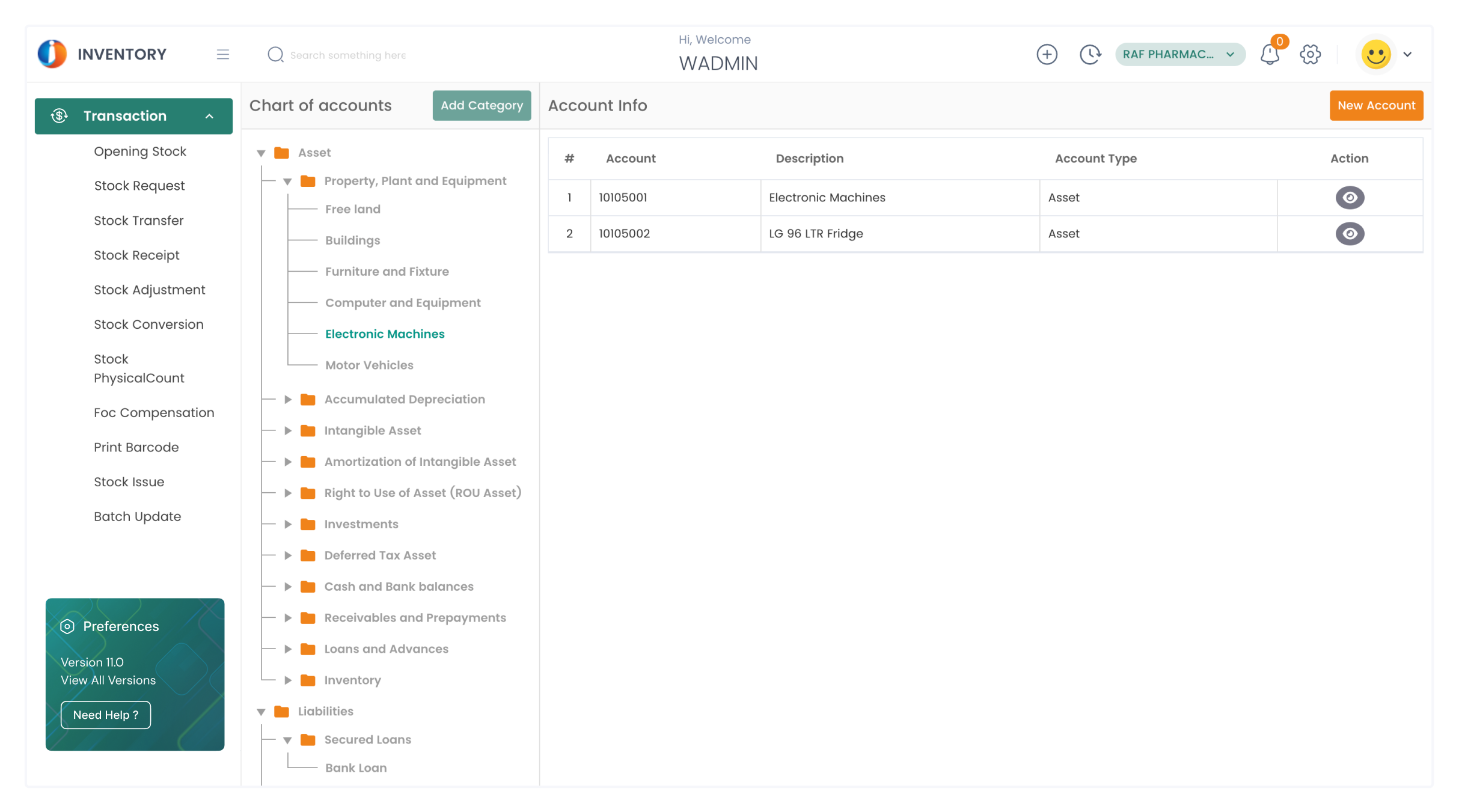

Chart of Account

Keep meticulous records of all financial transactions, organize and categorize financial information in a structured manner, simplifying tracking and analysis.

The chart of accounts provides a list of all the accounts in your company’s general ledger, divided into categories like assets, liabilities, owner’s equity, income, and expenses. You can budget and track easily, and generate reports as all the financial data is well-organized. This structured format not only ensures consistency and accuracy across departments, it also helps in making informed decisions and facilitates smooth audits. You can generate financial statements with this feature and also analyse business performance as you get a clear view of money inflows and outflows.

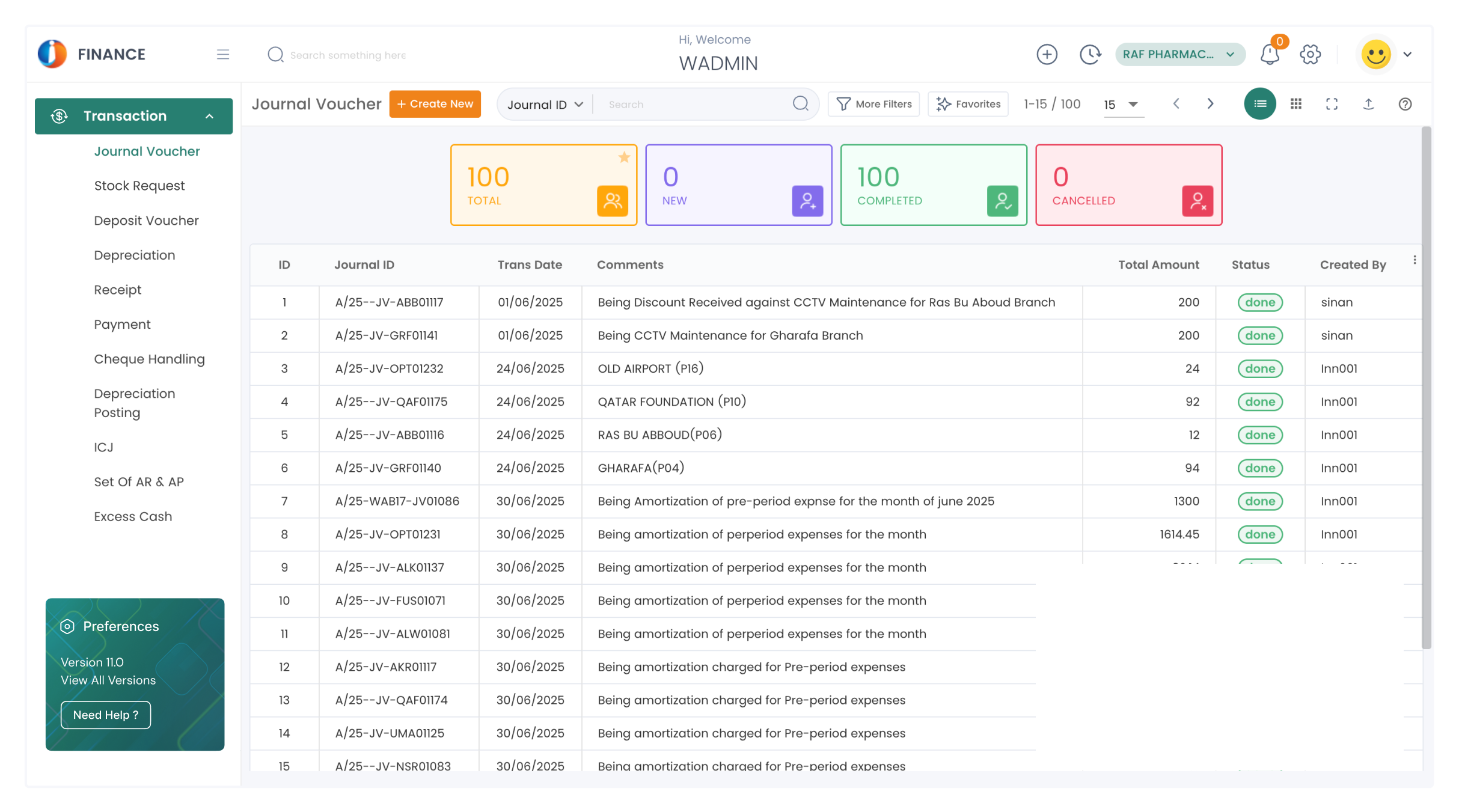

Journal Voucher

Seamlessly record financial transactions accurately, with controlled journal voucher entries, maintain compliance, and ensure audit-ready transparency.

This option is used to record non-cash transactions such as outstandings, adjustments, and internal transfers, even though the system enables maximum automated vouchers. You can ensure that all transactions are documented accurately, with appropriate debit and credit entries. With controlled journal voucher entry, you can minimize the risk of errors and fraud, follow internal controls, and ensure that financial activities adhere to accounting standards. As every voucher is backed by detailed documentation and approvals, it’s easier for you to track the purpose and origin of each entry. This also ensures the system is always audit-ready and fully transparent.

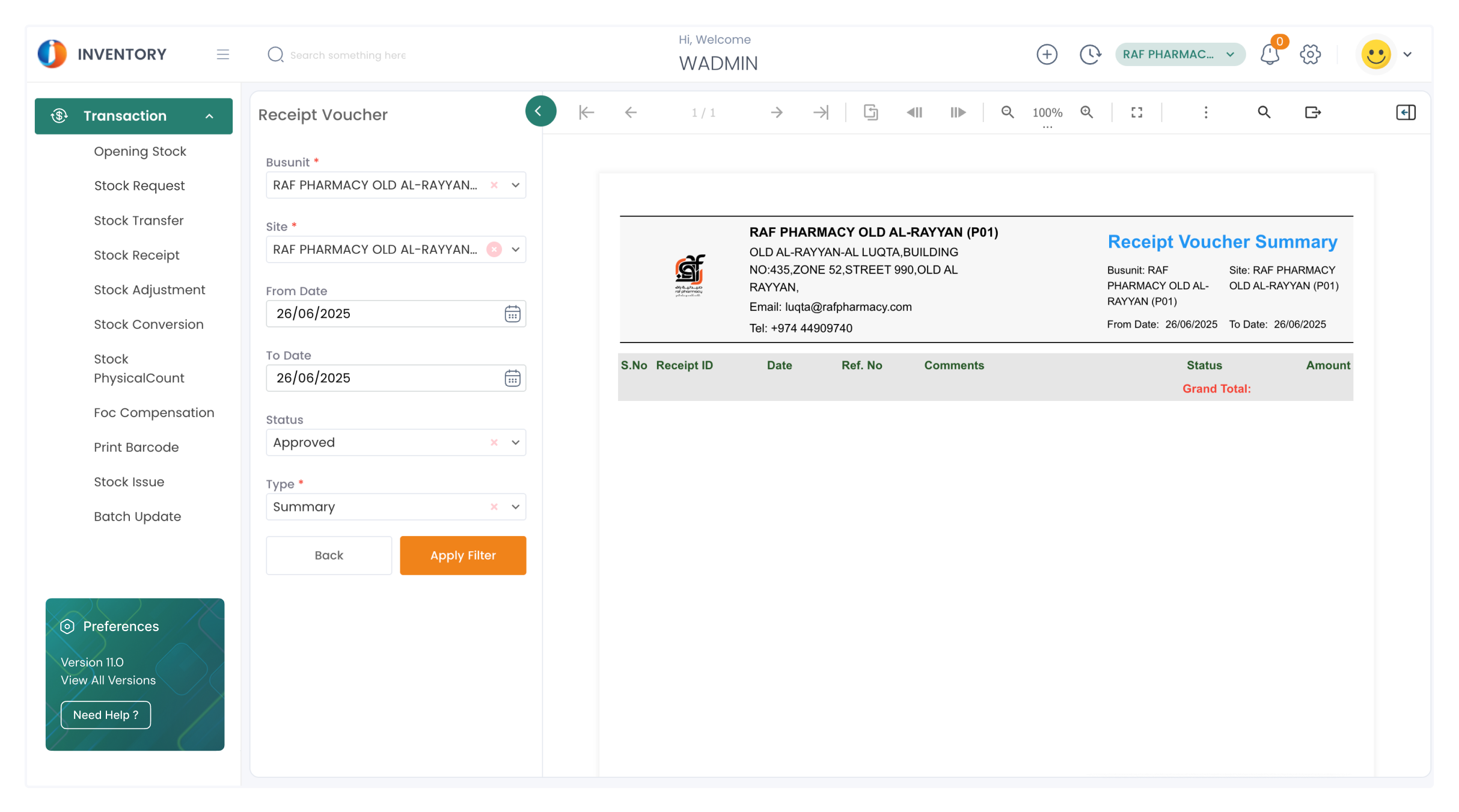

Receipt Voucher

Simplify receipt entry and settlement across payment modes, and ensure accurate financial reporting with transparent, centralized, error-free voucher management

Receipt Vouchers are used to document all types of incoming payments, through cash, cheque, bank transfers, or digital payment platforms. With this function, you can ensure that every inflow is accurately recorded, categorized, and reconciled in your system. You can track in real time and reduce manual errors by centralizing the receipt process. A well-managed receipt voucher system, can help you to perform precise financial reporting, strengthen internal controls, and speed up the reconciliation process. You also get a ready and easy reference for future audits and get clarity and visibility into customer payments.

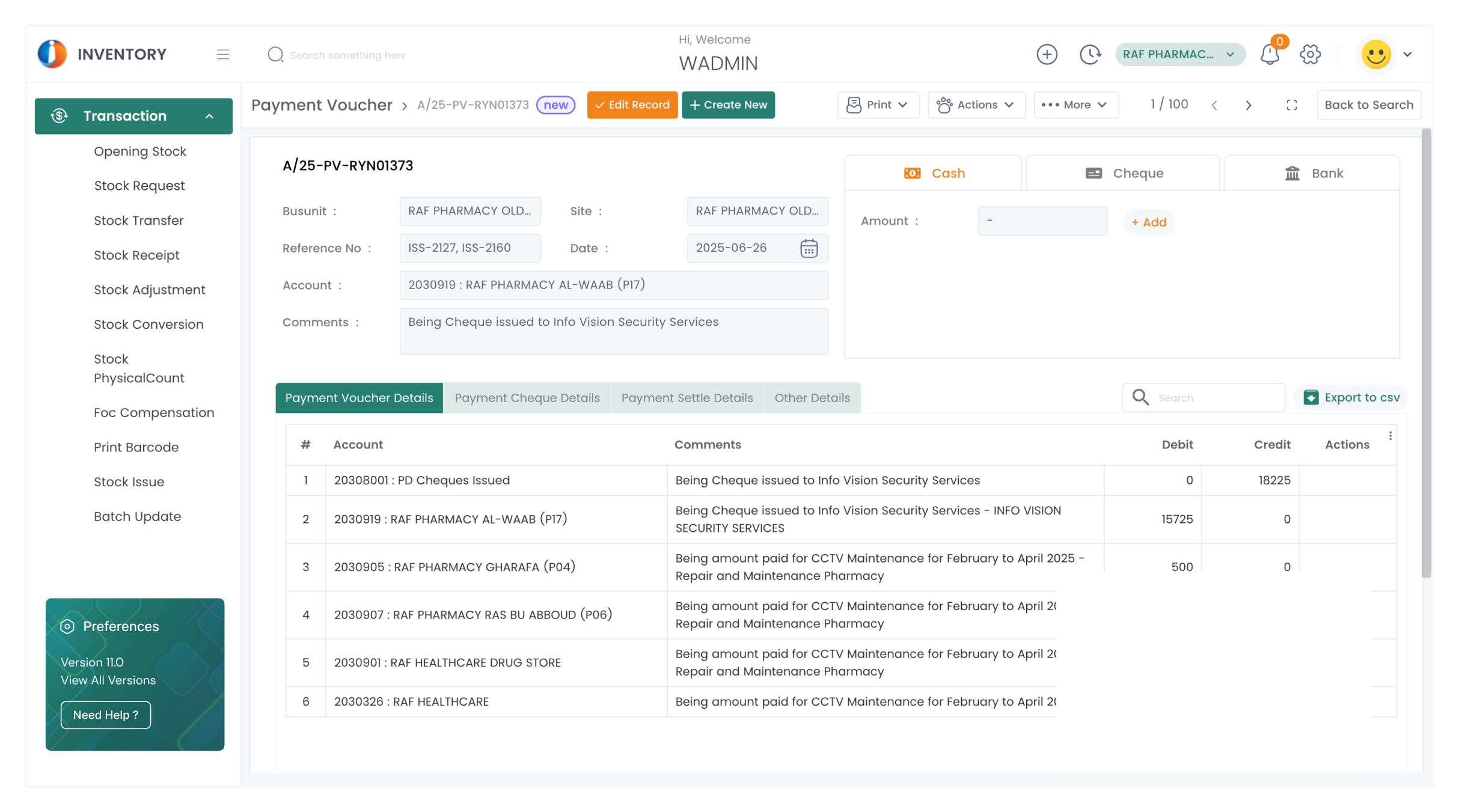

Payment Voucher

Simplify fund disbursements across business units with secure, verified, and audit-ready payment voucher entries

Payment Vouchers are essential for recording the disbursement of funds from your business. Whether you have to pay vendors, salaries, utility bills, or settle inter-department expenses, this facility ensures that each payment is verified, approved, and properly documented. This feature supports multiple payment modes and helps you to maintain compliance with internal policies and regulations too. Payment vouchers can be integrated with banking systems and payment gateways, thereby reducing manual work and boosting security. As all the requisite details are captured, this feature ensures your system is audit ready, facilitates transparency and accountability across your business units.

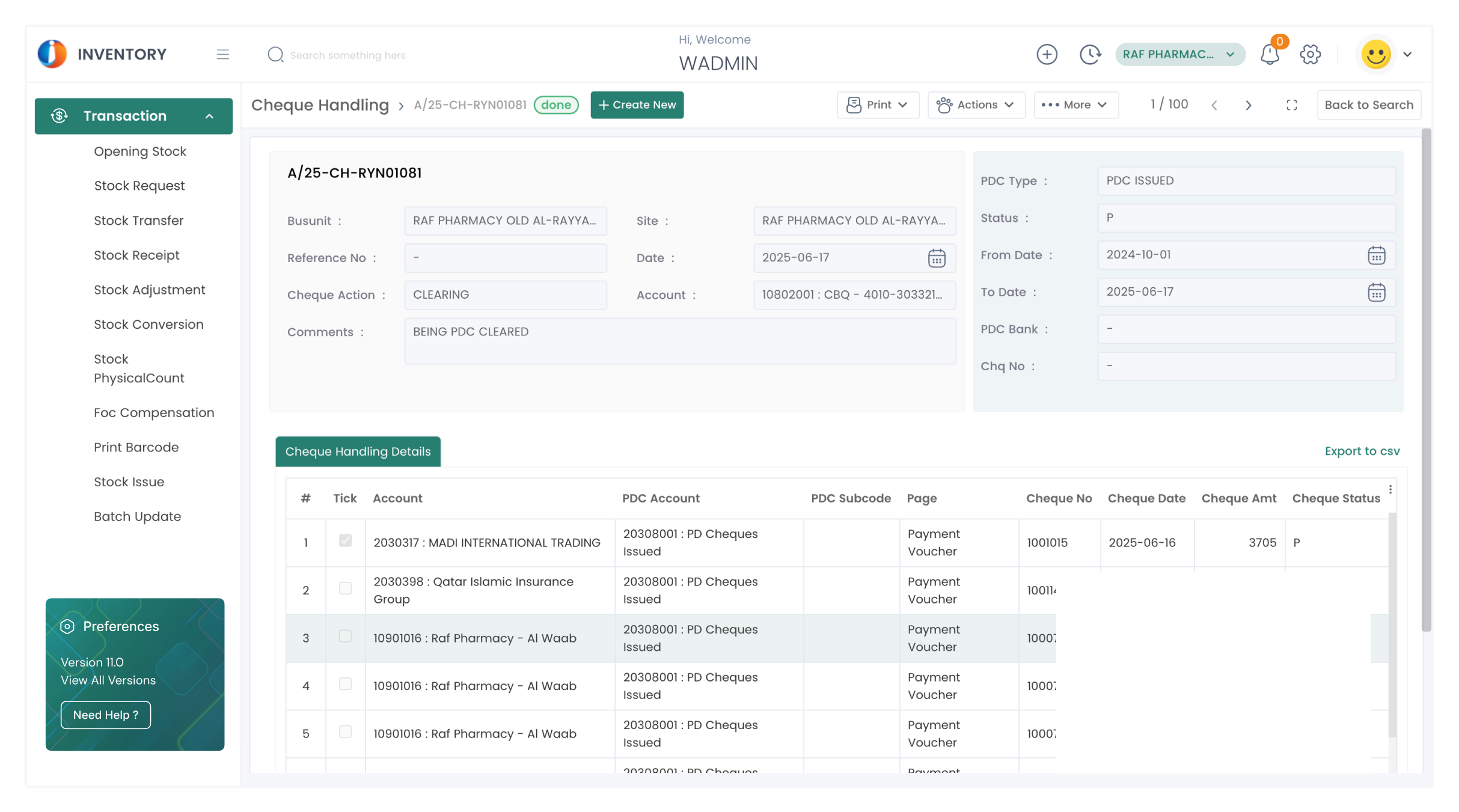

Cheque Handling

Track PDCs with precision and seamlessly manage received assets and issued liabilities through one unified system

For any business, handling cheques efficiency is a critical part of managing financial commitments and liquidity. With this feature you can easily track PDCs, cleared, and bounced checks with complete visibility. Through the central dashboard, you can manage issued and received cheques, as payments or receivables respectively. Automated reminders can be configured for cheque clearance and maturity, so that you don’t face delays in receiving or default payments. Ensure precise tracking of cheques coming in and going out with the correct status — (received or issued, deposited, cleared, or dishonoured), and whether they are post-dated or current. Automate management of cheque book and printing of cheques, and reduce manual effort.

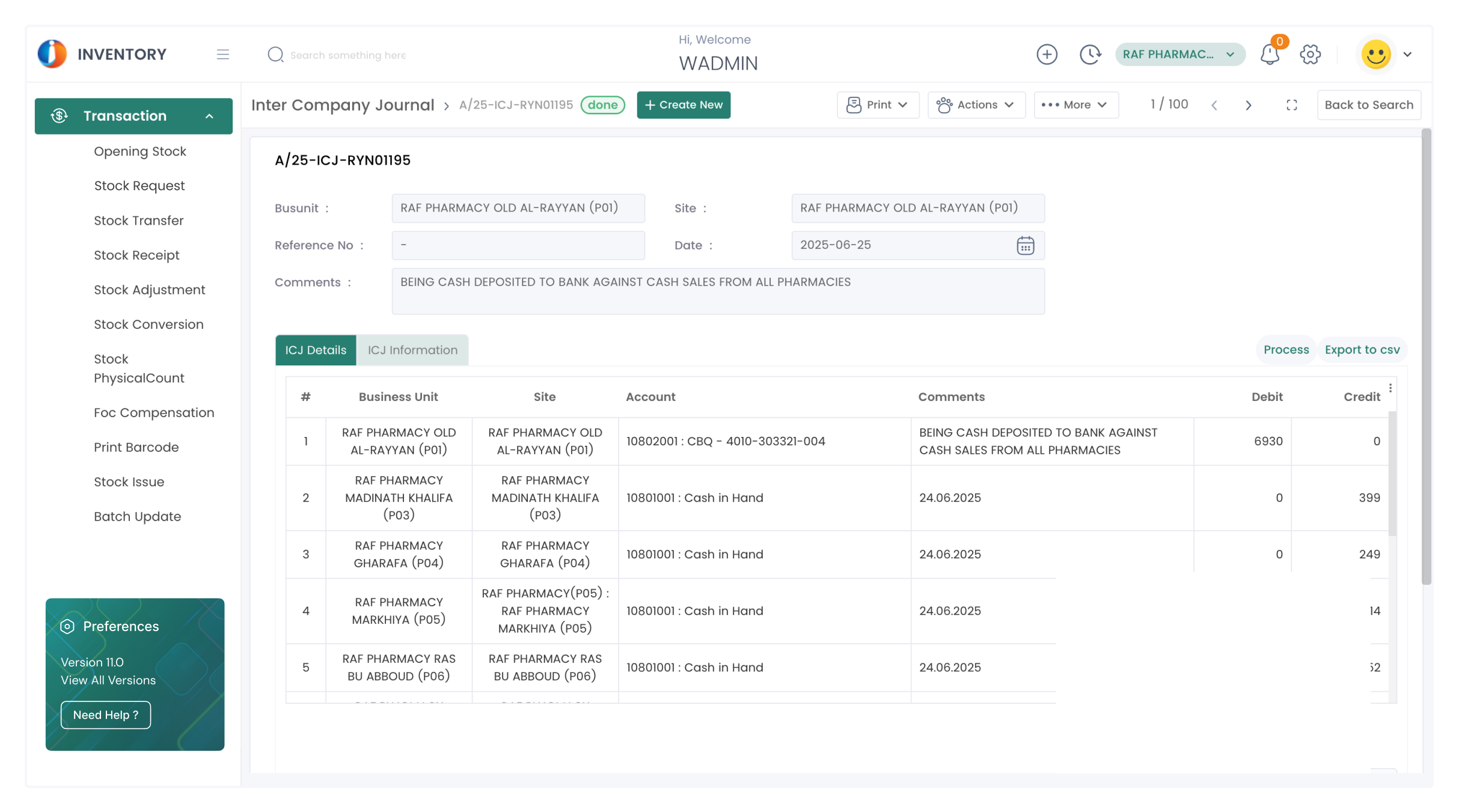

Inter Company Journals

Facilitate intra-group transactions—record and reconcile intercompany deals with full visibility and maintain compliance

Inter-Company Journal functionality becomes essential when you have multiple entities under the same umbrella. ICJ enables you to seamlessly record, reconcile, and report financial transactions among your various companies. This way, all shared services, internal transfer, and billing can be accurately recorded in all the companies’ books. It helps you to maintain complete audit trails and automated matching of corresponding entries, allowing you to be transparent and avoid inconsistencies. Financial reporting becomes a breeze, and adhering to regulatory compliance is simplified. Therefore, inter-company transactions don’t lead to liabilities that are ignored, or in double counting.